Peregrine Trader: Performance, Process, Plan

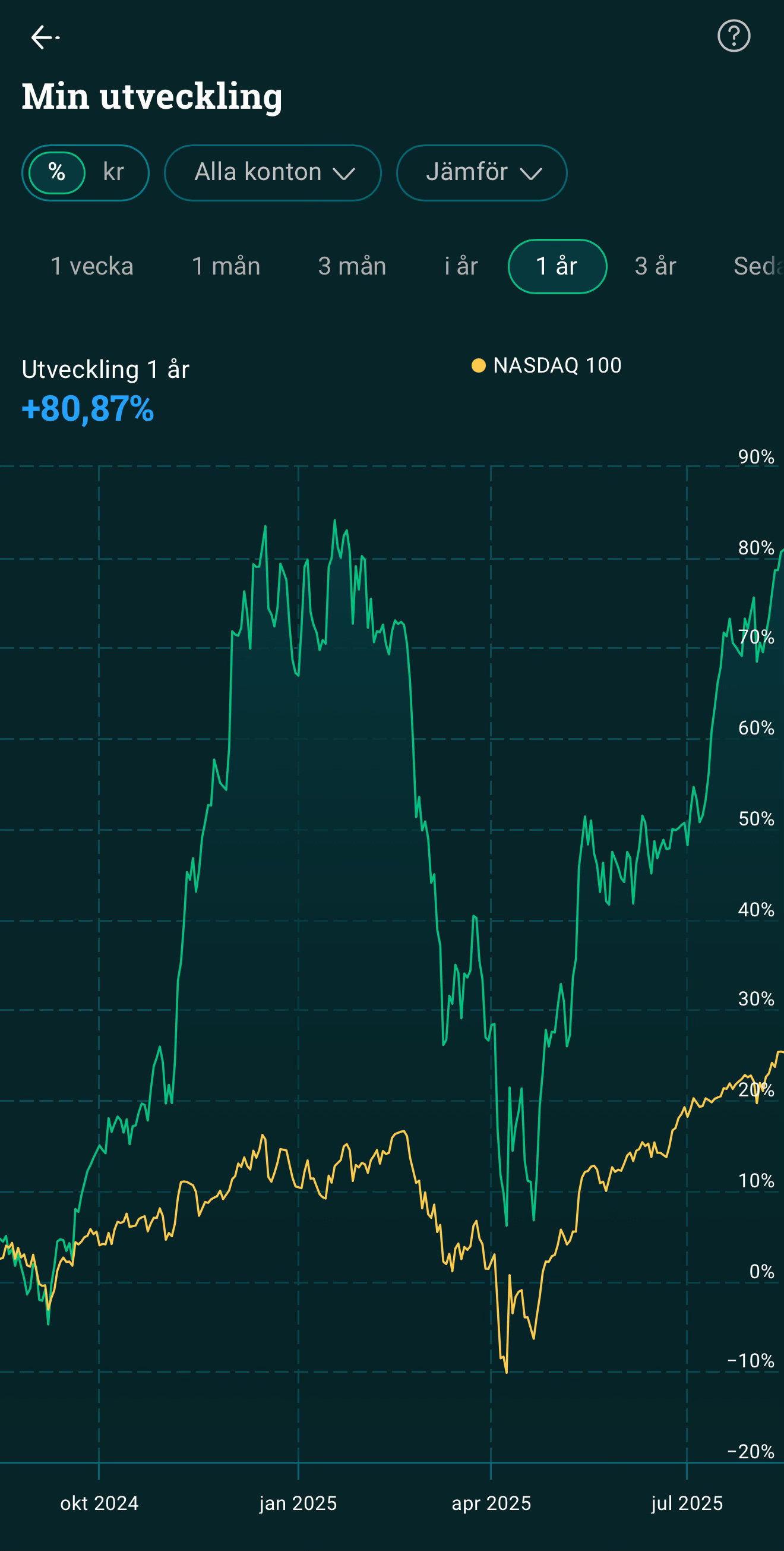

Above is my cumulative and year‑on‑year performance versus the Nasdaq‑100 for the past three years. My approach is intentionally high beta: it tends to outperform in bull runs and underperform during corrections/bear markets. Over multi‑year horizons equities trend up; my goal is to compound faster than the benchmark while staying realistic about drawdowns and enduring pain during corrections.

How this publication works: Each week I publish Falcon’s View with relevant market analysis. I post Stoop Alerts when I add/trim/exit, a monthly Ledger with full holdings, Holdings News as it breaks, and Idea Flow notes when I have insights to share.

Use this publication as input, not instruction.

— Subscribe to unlock analysis, strategies and my current positioning.

DISCLAIMER

This is not financial advice or a solicitation. It’s educational insight into my trades and market views. I share what I’m doing with my own money and the logic behind it–use it as input, not instruction. I may hold or trade any asset mentioned, and posts may appear after I act; timing and prices can differ. Information may change without notice and is not guaranteed complete or accurate. Markets involve risk; you are solely responsible for your decisions. Past performance is not indicative of future results.