Falcon’s View – Week ending 31 October 2025

Falcon’s View — Week ending 31 Oct 2025

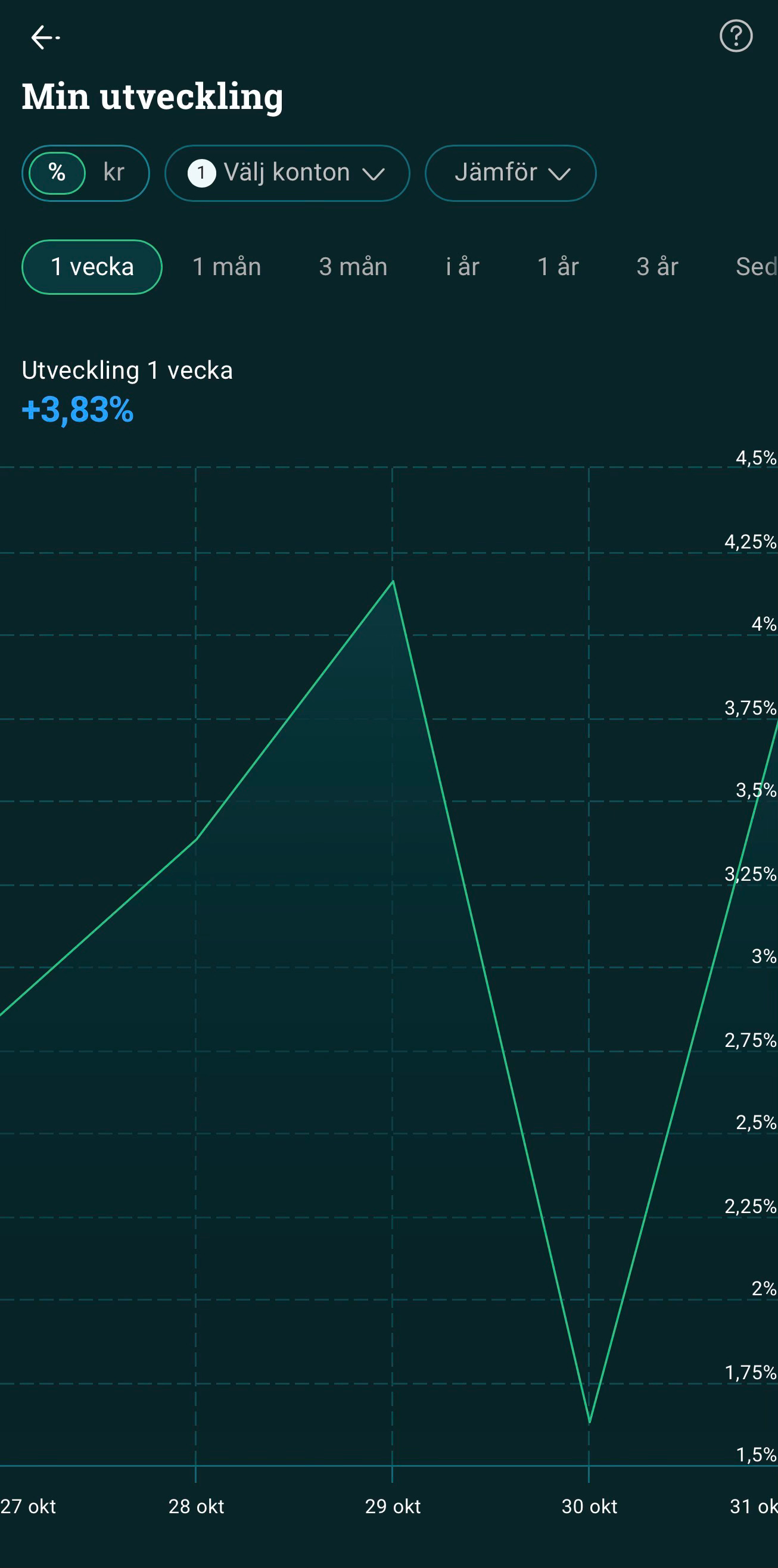

Performance

• S&P 500: 0.71%

• Nasdaq 100: 1.97%

• My portfolio: 2.73% (USD) / 3.83% (SEK)

Market pulse

Stocks climbed into Wednesday on hopes the Fed would keep cutting. The FOMC cut 25 bp and said balance‑sheet runoff ends Dec 1, but Powell added a December cut is far from guaranteed and policy isn’t on a preset course. Futures quickly repriced December odds lower, Treasury yields bounced, and the Nasdaq 100 faded off record highs into Thu–Fri. Amazon’s strong print helped cushion tech, but the post‑Fed repricing set the late‑week direction; Friday’s PCE mostly calibrated yields rather than changing the trend.

Crowd vs. price

Most of my names saw higher relative demand versus my watchlist. Amazon, Apple and Tesla bucked the trend and declined in relative interest.