Falcon’s View – Week ending 3 Oct 2025

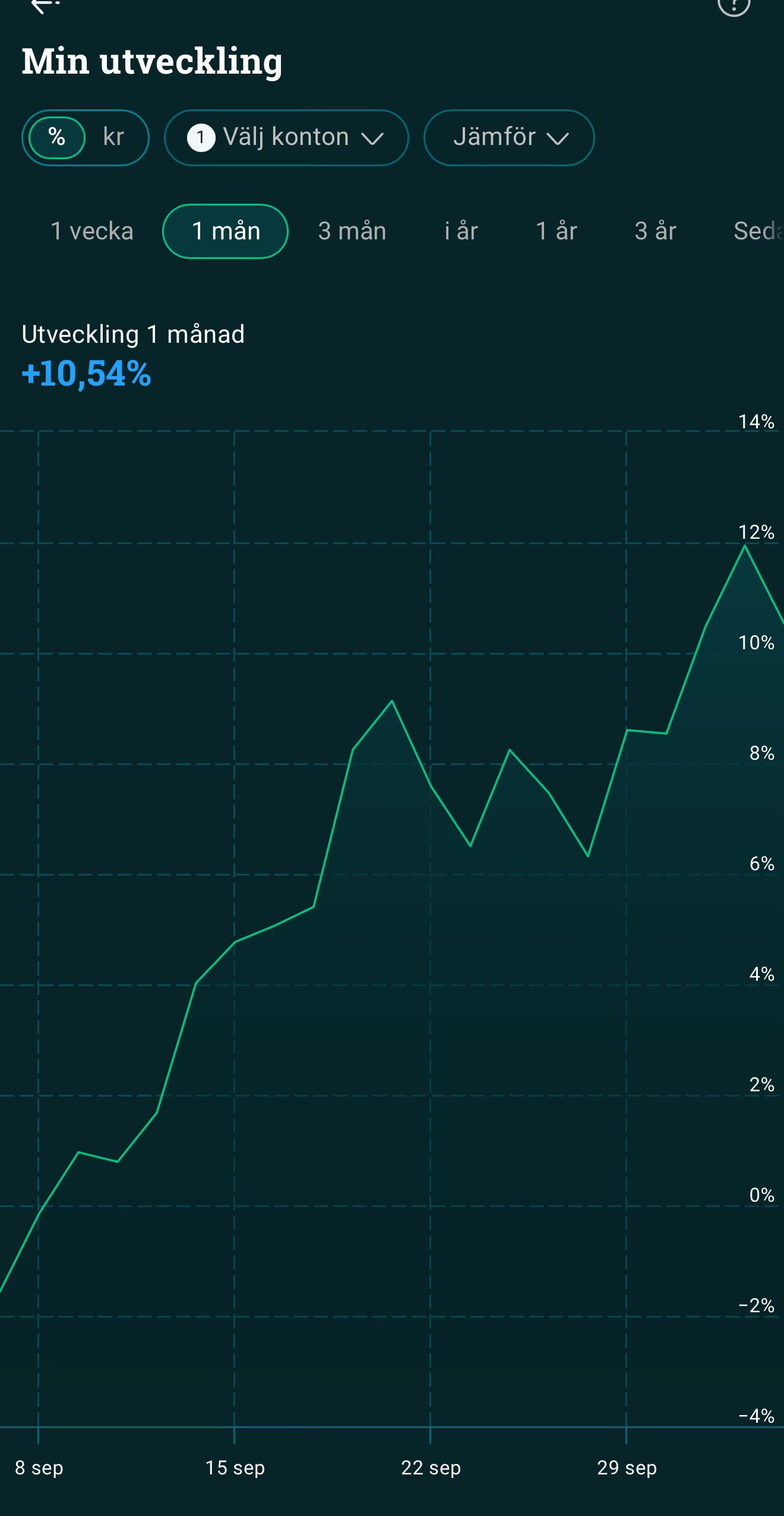

Performance

• S&P 500: 0,81%

• Nasdaq 100: 0,64%

• My portfolio: 3,98% (USD) / 3,97% (SEK)

Market pulse

Jobs‑data blackout + weak private payrolls. The federal shutdown blocked the BLS jobs report, so the street leaned on private reads. ADP −32k for September, the weakest since 2020. Net: more conviction in further Fed cuts, but higher day‑to‑day uncertainty.

Services PMI stalled at the brink. ISM Services 50,0 vs 52,0 in August, with new orders down sharply and employment still in contraction. Cooling growth at the largest part of the economy supports rate‑cut odds and helps long‑duration tech.

Manufacturing still contracting. ISM Manufacturing 49,1 (7th contractionary print in 8 months). A weak factory tape feeds the lower‑rates narrative, typically a tailwind for NDX multiples.

Crowd vs. price

For most names on my list, crowd interest was stable. Notable exceptions: Tesla, NVIDIA and Rheinmetall saw declines in relative crowd interest.