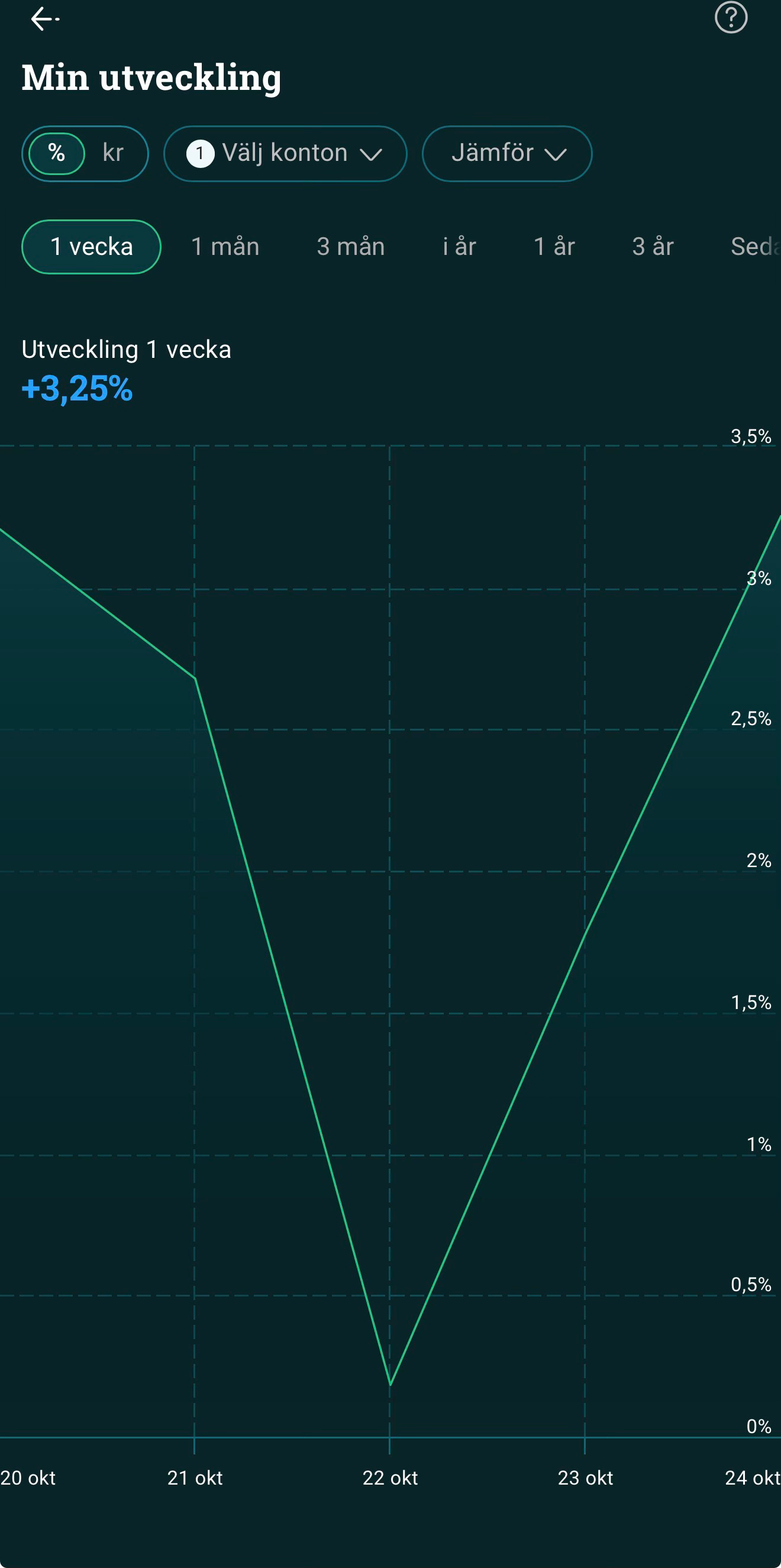

Falcon’s View – Week ending 24 October 2025

Performance

• S&P 500: 1,9%

• Nasdaq 100: 2,18%

• My portfolio: 3,27% (USD) / 3,25% (SEK)

Market pulse

Into Friday, the September CPI print was the swing factor: core m/m drove Treasury yields, which in turn set the tone for mega‑cap tech. A cooler read supported multiples and kept the NDX bid into the close. Mid‑week, mega‑cap earnings (Netflix, Tesla, Intel) steered single‑name moves and sector sentiment: streamers traded on subs/ads, autos on margins/price mix/FSD, and semis on AI capex and foundry progress. Net: data plus earnings put a floor under risk appetite, and indexes finished the week higher.

Crowd vs. price

Most names were stable in relative crowd interest. Palantir fell in relative interest, while Netflix saw a strong reboundin relative interest despite its price drop.